The State of FinOps Report 2025 lists cost allocation as the second-highest priority for FinOps teams.

What does that have to do with MSPs? While they may not always have in-house FinOps teams, they’re still on the hook to support client FinOps goals.

As the dominant cloud provider, AWS is often where MSPs first encounter consolidated billing. By linking multiple accounts under a single payer, AWS makes invoicing easier and provides discounts.

The bad news? Those same consolidated bills don’t deliver the client-level visibility FinOps teams expect, and challenges arise when allocating costs back to individual clients. AWS designed consolidated billing for single enterprises, not for MSPs managing multiple customers.

The good news: in this guide, we’ll show you how AWS consolidated billing works, where it helps MSPs, the limits of native tools, and the practices and platforms that set you up for success.

The AWS Consolidated Billing Cheat Sheet

| What It Is | Why MSPs Use It | Watch Out For |

| Payer + linked accounts under AWS Organizations | Centralized billing and shared usage discounts | Limited granularity for per-client reporting |

| Volume-based discounts across accounts | Unlock savings from pooled Reserved Instances and Savings Plans | Savings attribution can be unclear without tagging |

| Single invoice for multiple clients | Streamlined invoicing and predictable revenue | Native reports lack margin tracking |

How AWS Consolidated Billing Works

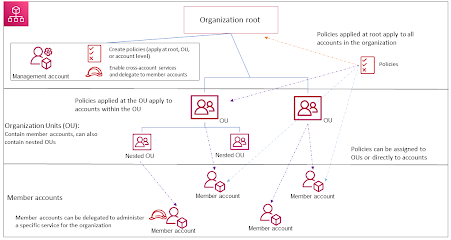

AWS consolidated billing operates through a service called AWS Organizations, which allows MSPs to create a single payer account and link multiple member accounts underneath it. One payer account is designated, and all usage from those linked accounts consolidates into the payer account.

Source: Amazon

That setup delivers two immediate benefits:

- Single invoice – instead of dozens of separate AWS bills.

- Shared discounts – pooled usage qualifies for volume-based savings on Reserved Instances (RIs) and Savings Plans.

Example: An MSP manages three clients: a small marketing agency, a SaaS startup, and a nonprofit. Individually, none spends enough on EC2 to qualify for a discount. But under consolidated billing, their pooled usage gives access to shared discounts that lower costs across all three accounts.

Watch out for: AWS allocates discounts at the account level, not the client level. Without tags or third-party reporting, it’s difficult to show each client how much they benefited from the pooled savings.

Pro Tip: Treat consolidated billing as the foundation, but layer in strong cost allocation tags. That way, when pooled savings apply, you can still break down which client consumed what.

Benefits of Consolidated Billing for MSPs

The immediate upside of AWS consolidated billing is that it reduces billing chaos. MSPs see quick wins like consolidating multiple client invoices into one, centralizing account management, and automatically applying pooled discounts. Over time, the same foundation provides long-term advantages by strengthening operations and deepening client relationships.

Here’s a deeper look at what those benefits look like:

1. Streamlined invoicing

Instead of tracking separate AWS invoices for every client account, all usage rolls into a single payer account. That reduces billing complexity and admin work, freeing MSP teams to focus on higher-value tasks.

Example: An MSP managing 15 SMB clients used to spend hours reconciling separate AWS invoices across accounts each month. By moving those accounts under AWS consolidated billing, the provider now receives a single central invoice, reducing billing time by more than 50%.

Watch out for: Central invoicing, which doesn’t automatically break down spend per client.

Pro Tip: Automate invoice splitting with a third-party platform. The more you can eliminate manual reconciliation, the more margin you protect.

2. Improved cash flow visibility

With all usage consolidated, MSPs can more accurately predict roll-ups of client spend and align it with their own billing cycles, creating a steadier cash flow and reducing surprises.

Example: An MSP provider offering monthly flat-rate AWS services can better forecast margins because client consumption trends are visible in aggregate through AWS consolidated billing instead of scattered across accounts.

Watch out for: Only looking at the consolidated view, you might miss anomalies in individual accounts!

Pro Tip: Pair consolidated billing with anomaly detection to catch outliers before they impact cash flow.

3. Volume-based discounts

Pooled usage across accounts qualifies for bigger discounts on Reserved Instances (RIs) and Savings Plans. Individually, smaller clients may not reach these thresholds, but together they can.

Example: Three clients each run small EC2 environments that don’t meet AWS’s minimums for discounts. By combining them under consolidated billing, the MSP unlocks shared savings that improve both client satisfaction and provider profitability.

Watch out for: AWS applies discounts at the payer-account level, not by client. Without attribution, clients may dispute whether they’re getting their “fair share” of the pooled savings.

Pro Tip: Combine consolidated billing with structured AWS cost optimization practices like tagging and automated reporting to maximize savings and prove value to clients.

4. Stronger client trust

Transparent, centralized reporting shows clients that their costs are being managed responsibly. For MSPs, this trust is a key differentiator — clients want to know their provider has both cost and governance under control.

Example: A financial services client insists on quarterly reporting tied to compliance metrics. With consolidated billing, the MSP can present one clear report that aligns costs with usage, strengthening confidence in the partnership.

Watch out for: Native AWS reports aren’t designed for MSP branding or client delivery. Sending raw AWS data can confuse non-technical stakeholders.

Pro Tip: Customize client reports with branding, commentary, and recommendations — showing value beyond the numbers.

The Limits of Native AWS Tools for MSPs

While AWS consolidated billing simplifies invoicing and enables pooled discounts, the native AWS tools that support it weren’t built for MSP use cases. They work well for single enterprises but fall short when you’re managing multiple clients.

Here’s a breakdown of the bottlenecks of working with AWS native tools for MSPs and why billing can be such a headache.

1. Limited client-level visibility

AWS consolidated billing aggregates costs under the payer account, but it doesn’t automatically split usage by client.

Example: An MSP tries to show each client their share of pooled EC2 discounts. With only the consolidated invoice, there’s no clear way to allocate costs fairly across clients.

Watch out for: Clients may push back if they can’t see proof of their share of the discounts and become frustrated with the MSP services.

Pro Tip: Employ consistent cost allocation tags at the start of every client engagement. It’s the only way to break down consolidated billing into client-ready reports (third-party tools can help with this).

2. No margin tracking

AWS Cost Explorer and Budgets can show overall spend, but they don’t account for MSP markups or service costs, making it impossible to track profitability at the client level.

Example: An MSP sets flat-rate pricing for AWS services but can’t tell if pooled usage discounts are improving margins, because consolidated billing only shows AWS’s costs, not the provider’s.

Watch out for: Without margin tracking, you may end up serving high-usage clients at a loss without realizing it.

Pro Tip: Layer margin analysis on top of consolidated billing data using third-party tools. Profitability should be as visible as spend.

3. Manual re-billing

AWS consolidated billing doesn’t generate client-facing invoices, so it’s up to MSPs to break out costs, apply markups, and produce invoices that make sense to clients.

Example: A provider with 20 linked AWS accounts spends days each month exporting data from Cost Explorer, tagging usage, and formatting spreadsheets into client invoices.

Watch out for: Manual re-billing introduces human error, which can lead to disputes and unpaid invoices.

Pro Tip: Automate re-billing workflows with a platform that integrates directly with AWS consolidated billing data.

4. Gaps in multi-cloud environments

AWS consolidated billing works only inside AWS, and most MSPs manage multi-cloud environments, which means you still need to reconcile Azure, GCP, and SaaS accounts separately.

Example: An MSP supporting a global retailer runs workloads in AWS, Azure, and GCP. Consolidated billing simplifies AWS invoices, but the provider still struggles to present a single, unified report across all clouds.

Watch out for: Clients with multi-cloud strategies may view AWS-only reports as incomplete, making it harder to prove your value as their strategic partner.

Pro Tip: Choose a platform that extends AWS consolidated billing with multi-cloud visibility. That way, clients get one complete financial picture across their environments.

How to Maximize AWS Billing Efficiency as an MSP

AWS consolidated billing gives MSPs a strong foundation, but as previously discussed, it takes the right practices to turn that foundation into true efficiency and profitability. Here’s how to get the most from it:

1. Leverage shared Reserved Instances (RIs) and Savings Plans

When client usage is pooled under consolidated billing, you can buy RIs and Savings Plans at scale and apply discounts across accounts.

Example: An MSP serving five small clients uses consolidated billing to purchase a single Savings Plan large enough to cover all their EC2 usage. Each client benefits from lower costs, while the MSP increases margin predictability.

Watch out for: Without clear allocation, clients may argue about whether they’re receiving their “fair share” of the discounts.

Pro Tip: Use detailed reporting to show clients exactly how RIs and Savings Plan savings are distributed across their accounts.

2. Enforce strict cost allocation tagging

Consolidated billing provides a strong foundation, and by using tags, you can accurately allocate costs between clients.

Example: A fast-growing SaaS company adds new AWS accounts each quarter. Because the MSP enforces a strict tagging policy, each new account integrates smoothly into AWS consolidated billing, and usage is automatically monitored at the client and department levels.

Watch out for: Tagging retroactively is a nightmare, and inconsistent tags create reporting gaps and client disputes.

Pro Tip: Make tagging non-negotiable in client onboarding. Standardize keys (e.g., ClientName, Project, Environment) so reports are consistent from day one.

3. Automate reporting and re-billing

Native AWS tools provide raw billing data, but they don’t generate client-facing reports. MSPs that handle this manually risk delays and errors.

Example: With AWS consolidated billing feeding into an automated reporting platform, an MSP can transform raw AWS billing data into branded, client-ready reports. Instead of wrestling with spreadsheets, clients get timely, accurate invoices that reinforce trust.

Watch out for: Manual processes don’t scale if you decide to take that route. As you add more clients, re-billing becomes a drag on margins.

Pro Tip: Automate re-billing by integrating consolidated billing with third-party platforms that generate branded, client-ready invoices.

4. Pair consolidated billing with anomaly detection

Pooled billing makes it easy to miss spikes in individual accounts. An unexpected surge can go unnoticed until the consolidated invoice arrives.

Example: One client in a consolidated group accidentally leaves test environments running. The cost spike is hidden inside the consolidated bill until the month-end, hurting the MSP’s margin.

Watch out for: Consolidation hides anomalies unless you’re monitoring account-level usage.

Pro Tip: Use anomaly detection tools on top of consolidated billing to catch unusual activity early and preserve profitability.

Third-Party Tools: Why MSPs Need More Than Native AWS

Since native AWS tools were built for single enterprises, not service providers who need to track margins, re-bill clients, and report across platforms, that’s where third-party tools come in.

1. Automated re-billing and client invoices

Third-party platforms take raw consolidated billing data and automatically generate client-ready invoices, complete with markups and custom branding.

Example: An MSP managing 30 AWS accounts uses Umbrella to convert the payer account’s consolidated invoice into individual, client-branded invoices, and the best part? No spreadsheets required!

Pro Tip: Choose tools that let you set pricing models (markup, pass-through, tiered) once, then apply them consistently across all clients.

2. Margin tracking and profitability insights

AWS shows spend, but not profit. Third-party platforms calculate margins by layering service costs and pricing structures on top of consolidated billing data.

Example: A provider offering flat-rate AWS services uses Umbrella to see margin trends by client. When one client’s workloads grow faster than expected, the MSP can flag the issue and adjust pricing before profitability erodes.

Pro Tip: Monitor margins client by client, not just in aggregate. Profitability is the true measure of sustainability.

3. Multi-cloud visibility

Most MSPs manage more than AWS alone. Third-party platforms aggregate billing across AWS, Azure, GCP, and SaaS, providing a single view for both the MSP and the client.

Example: An MSP supporting a global retailer combines AWS consolidated billing with Azure and GCP data inside Umbrella. Instead of receiving three separate reports, the client now has a unified dashboard of cloud costs. This type of cloud cost management gives clients the transparency they expect across their entire environment.

Pro Tip: Make multi-cloud reporting a standard offering. It positions you as a strategic partner, not just an AWS reseller.

4. Advanced FinOps reporting

Third-party tools go beyond invoices to deliver ROI dashboards, anomaly alerts, and compliance reporting, all tied to client outcomes.

Example: A healthcare client needs HIPAA-compliant reporting. By layering Umbrella’s FinOps insights on top of AWS consolidated billing, the MSP provides both financial transparency and compliance proof in a single report. For many providers, this is where cloud cost management for MSPs becomes a real differentiator.

Pro Tip: Use reporting as a differentiator. Branded, outcome-driven dashboards add value beyond simple cost data.

Implementation Tips for MSPs

Adopting AWS consolidated billing means MSPs need a structured rollout to avoid confusion and establish a foundation for client trust.

1. Audit existing billing systems

Before linking accounts, make sure your current billing setup can integrate smoothly with consolidated billing.

Example: An MSP using a legacy billing tool tested how AWS consolidated billing data exported into their system. The audit revealed gaps in margin tracking, so they added a reporting layer before migrating all clients.

Watch out for: Jumping in without reviewing compatibility can create reconciliation headaches later.

Pro Tip: Run a pilot with one or two accounts first. Fix issues on a small scale before moving your whole client base.

2. Define pricing structures upfront

Consolidated billing is only helpful if you’ve decided how to pass along costs: markup, pass-through, or hybrid.

Example: An MSP offering flat-rate services built a pricing model that included pooled AWS discounts. They communicated clearly how those savings factored into the monthly fee.

Watch out for: If clients don’t understand how discounts are shared, they may assume you’re keeping all the benefits.

Pro Tip: Document pricing rules in contracts and QBR decks to keep expectations clear.

3. Prepare clients with clear communication

Clients need to know what’s changing and how they’ll benefit.

Example: A provider rolled out AWS consolidated billing to 10 clients and sent proactive communications explaining that invoices would look different but would be easier to read.

Watch out for: Surprising clients with a new invoice format can lead to disputes, even if the bill is accurate.

Pro Tip: Position the change as a value-add, such as simplified billing and greater visibility into their cloud costs.

4. Align reporting with compliance and financial controls

Consolidated billing must still meet industry, legal, and internal standards.

Example: A financial services client required SOC 2–aligned reports. The MSP used Umbrella to pull AWS consolidated billing data into compliant reports, avoiding gaps during audits.

Watch out for: Assuming AWS-native reports automatically meet compliance needs. They often don’t.

Pro Tip: Map reporting requirements before rollout. If a client is in a regulated industry, confirm how consolidated billing data will be presented for audits.

Turn Billing Into a Growth Engine

For MSPs, billing correctly means enabling cost allocation, strengthening client trust, and building predictable revenue streams.

AWS consolidated billing provides the basics, but it’s not designed for multi-tenant MSP environments. Without client-level visibility, margin tracking, or automated re-billing, providers risk losing both profitability and credibility.

The MSPs that succeed are the ones who build on consolidated billing with cost allocation policies, anomaly detection, and third-party platforms designed for cloud cost management for MSPs. With the right approach, billing shifts from a back-office chore into a true growth engine.