So, there is a lot of information out there regarding FinOps.

And a ton of courses, guides, how-tos, frameworks, and so much more.

However, sometimes you just need a grasp of the basic concepts before you go digging into the more advanced stuff.

So, rather than talk about the Crawl, Walk, Run approach or the Ingestion, Visibility, Allocation, and Reporting techniques, let’s really have a look at the basics.

What is FinOps and Why Do We Need It?

Well, the original concept of FinOps started around 10 years ago with the rapid adoption of cloud services. As more and more companies moved workloads to the cloud, their cloud spend grew. A common problem started showing up, something known as bill shock.

Why bill shock?

Well, a client would receive a bill much higher than what they anticipated and receive a shock.

Imagine if your usual cloud bill is $15,000 and you suddenly receive an invoice for $40,000, you’d be shocked.

The reason this happens is that cloud spend is billed on a metered basis, similar to water and electricity. So, the more you use, the more you pay. No fixed prices!

There are also a lot of hidden costs, such as traffic, that can greatly affect your final bill.

How FinOps Helps Manage Cloud Costs

So the role of FinOps was born. And it’s not just about monitoring costs or avoiding bill shock.

It’s about:

- Cost visualisation and allocation – helping understand who or what has incurred costs and what exactly those costs are.

Whether it’s departments, projects, or customers running services, they (and you) need to know how much they spent and what they spent it on. - Budget management – tracking usage against set budgets and knowing when you’re likely to go over. This also includes setting thresholds, forecasting, and staying ahead of unexpected spikes.

- Cost reduction – finding ways to lower cloud spend without impacting performance. This could be cleaning up unused resources, optimizing reservations, or right-sizing workloads.

- Creating cost reports at both admin and technical levels. A CFO will want a different report than a project manager or the head of R&D

This list will obviously vary and grow based on different companies’ needs.

Key FinOps Concepts and Terms

Pay-As-You-Go / On-Demand Pricing

This is the common term(s) for standard cloud pricing. You pay for resources based on actual usage, usually at publicly listed prices.

Reservation / Reserved Instance (RI)

This term relates to purchasing an instance type with a commitment of typically 1 or 3 years.

By committing, you get a discount — around 35–40% for 1 year and 60–70% for 3 years.

Downside is, if you power off or delete the instance, you still pay. It’s a pre-paid commitment.

Some cloud providers do allow cancellation, but terms vary.

Savings Plan

Also a commit-based plan for 1 or 3 years, but here you commit to a minimum level of hourly spend.

Savings plans are more dynamic. Unlike RIs that are tied to specific resources and regions, savings plans can apply across supported resources and all regions at the same time.

Because of the flexibility, the discount is a bit lower — around 30% for 1 year and 50–55% for 3 years.

Chargeback and Showback

This is the ability to take your overall cloud bill and allocate charges according to business needs.

It’s called chargeback when business units are actually billed for their portion of the usage.

Budget Management

This is where you track actual usage against budgeted or estimated costs.

Forecasting is key here — it lets you know if you’re on track to blow your budget.

Just like chargeback, budget tracking should be done not just at account level but also per business unit.

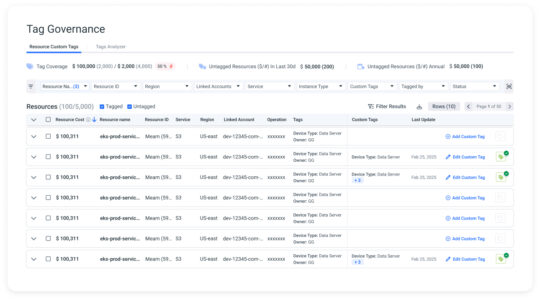

Tags (a.k.a. the Terrible T Word)

Tagging is when you add metadata to a resource in the cloud.

Each tag has a name and a value. For example:

Owner: Mike

Environment: Prod or Dev

Tags help identify ownership, purpose, and other key attributes of cloud resources.

They’re especially useful for:

- Finding who to contact

- Filtering costs (e.g. only Prod, or only resources owned by Mike)

- Improving showback and chargeback accuracy

Final Thoughts and a Quick Win Tip

Knowing and understanding these basics will help you kick off your FinOps journey.

And here’s a tip for a quick win:

Start with implementing Reservations and Savings Plans — they can deliver solid cost savings early on.

But before committing, clean up the environment and make sure those resources will be in use for the next year. Otherwise, you could end up paying for things you no longer need.